Balancing Risk and Return for Long-Term Success

A successful real estate portfolio requires balance—mixing higher-risk, higher-reward opportunities with lower-risk, steadier investments. Scaffold Partners helps investors identify the right opportunities for their goals, backed by analysis of each investment’s risk-return profile.

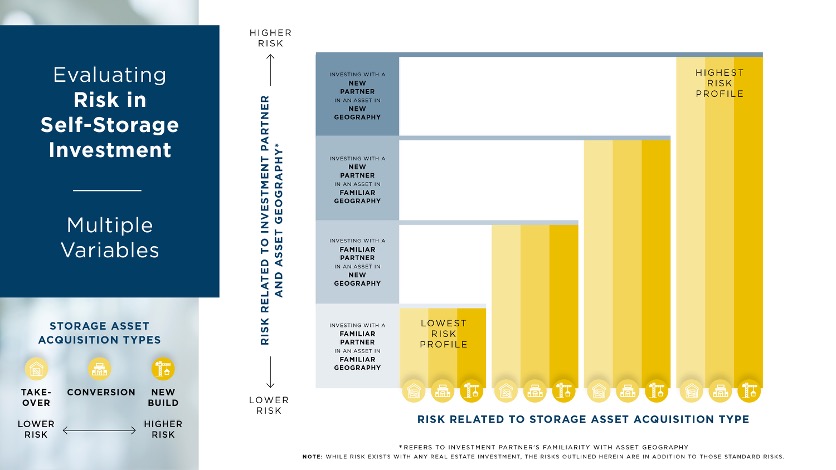

Key risk factors include:

- Market conditions (location, population trends, traffic flow, income levels)

- Facility type (new construction, building conversion, or acquisition of an existing facility)

We diversify portfolios by partnering with sponsors across different regions, communities, and facility types. For example, a lower-risk acquisition might involve taking over an established facility, while a higher-risk investment could involve ground up construction —with the potential for higher returns.

Protecting Our Investors

Every investment carries risk. At Scaffold Partners, we work to protect investors through rigorous vetting, alignment of interests, and full transparency.

- Sponsor Vetting & Investor Alignment

- We partner only with sponsors who have strong reputations, proven track records, and extensive self-storage experience.

- We conduct thorough due diligence and underwriting on every deal.

- Scaffold and its partners invest in every deal as limited partners, and structure deals with priority returns and IRR hurdles, ensuring both Scaffold and its partners have meaningful “skin in the game” and are aligned with our investors’ best interests.

- We encourage diversified portfolios and provide a range of opportunities to help mitigate risk.

- Disclosure & Safeguards

- We provide complete transparency on fees, deal terms, and sponsor details.

- We implement oversight to prevent partner sponsors from overleveraging and to ensure loans remain on reasonable terms.

- We offer fraud and negligence protections for additional peace of mind.

To keep investors informed, we share regular updates via quarterly reports, Zoom calls, email, and phone conversations. We also distribute educational resources to help investors better understand the self-storage market.

How it Works

Join Our Investor Network